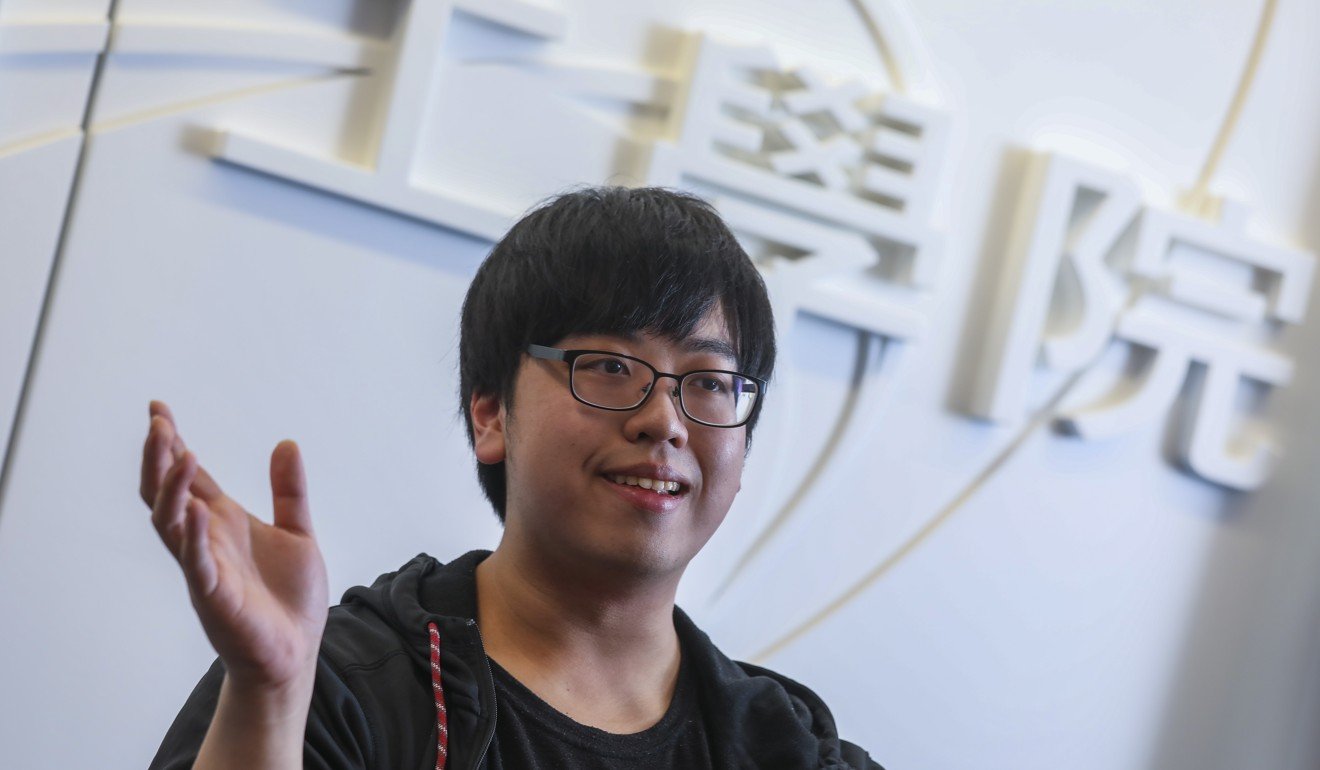

Kenta Iwasaki, the Hong Kong whizz kid, who wants to revolutionise the way we use cryptocurrency

- Kenta Iwasaki was making thousands of US dollars a month before he was 10 years old

- Now the 20-year-old Hong Kong University of Science and Technology student is out to change the world

Kenta Iwasaki wants to revolutionise cryptocurrency.

The 20-year-old undergraduate, who turned down offers from Stanford University and California Institute of Technology in the United States for an honour degree course at Hong Kong University of Science and Technology, believes the field has stagnated.

“There really needs to be something new, a new flavour to what you can do with cryptocurrency”, otherwise the technology will be wasted on basic coin exchange, he said.

And he is not just dreaming. The whizz kid recently raised HK$382 million (US$49 million) to fund a cryptocurrency driven marketplace that aims to change an industry floundering under sinking coin values, and a crisis of confidence.

The marketplace, named Perlin, is based on a blockchain created by Iwasaki himself, a self-taught programmer who as an eight-year old was already making thousands of US dollars a month from online software he developed.

Born to a Japanese and Chinese-Indonesian couple, Iwasaki moved to Hong Kong with his family when he was four years old. He learned programming through a constant process of trial and error.

His school grades suffered as he ran businesses, while also working as a graphic designer and web developer in high school, but he decided to pursue a computer science and engineering degree with a scholarship by Li Ka Shing Foundation.

Now, Iwasaki is set to launch Perlin, which provides a new model for how cryptocurrency is valued, and how companies source cloud computing power.

The great cryptocurrency crash of 2018 may not be over

It could also help people make money off their smartphones, enabling users to “sell [their] phone’s computing units temporarily every single night to an enterprise or a start-up”, Iwasaki said at an event on his university campus.

Iwasaki, and his international team of entrepreneurs and engineers, hope to have 50,000 smartphones connected to their network by the end of next year, providing computing power to companies in exchange for Perl, the market’s cryptocurrency.

That currency also looks to address a pressing problem in the industry. Because its value was linked to the price of computing power sold on the network, the coin was insulated from the speculative practices and pump-and-dump schemes that have destabilised cryptocurrencies in the past year, and cast a pall over the industry, Iwasaki said.

“Even if all of a sudden people stopped trading, stopped using the exchange to buy and sell, it would still have a fixed value, it wouldn’t just die off as a currency.”

At least 4,800 pump-and-dump frauds took place in the first six months of this year, according to a study published on December 18 by Tel Aviv University, the University of Tulsa, and University of New Mexico.

Such schemes involve a group of traders who manipulate coin values by buying coins en masse to drive up prices and then simultaneously sell.

While these schemes typically affect more obscure currencies, even major players such as bitcoin have seen volatility in value: the coin price went down 70 per cent this year.

Suspicions of manipulation have increased regulator scrutiny on cryptocurrencies across the world, which were already treated with caution by established financial institutions. The Hong Kong stock exchange’s regulator has expressed its reluctance to approve IPOs by cryptocurrency companies before proper rules are in place, according to sources.

Explainer: What is Hong Kong’s plan for licensing cryptocurrency exchanges

Officials said it was premature for companies in the industry to go public when regulatory framework was still being developed for the digital asset.

The volatility in coin exchanges and speculative practices does not only give cryptocurrencies a “bad name”, Iwasaki said, they also miss the potential of blockchain as a “trustless” technology.

Iwasaki and his partners see their use of this technology as social enterprise, with the potential to provide smartphones users in developing countries with free internet through their cellular providers or even, in their loftier goals, a universal basic income paid directly to phone owners.

Users with 2007 model smartphones could make US$1-US$3 in a six-hour period selling out their computing power, Iwasaki said.

A telecommunications carrier in Indonesia had already signed on as a partner, he added.

As for the future of Perlin, Iwasaki said that his hopes for how quickly it will spread “are exponential”.